Summary and Afterthought on the Second Annual Young Corporate Malaysians Summit

The ASEAN was once a hype word in the global market. However, its visibility was brought down largely by the emerging markets like China and India. With the rise of Indonesia and the ASEAN Economic Community 2015 nearing its deadline, it is only timely that we look at ASEAN once again. This is why Young Corporate Malaysians set ASEAN: Emerging Opportunities and Challenges as this year’s theme.

The event was indeed a success with its record breaking amount of sponsorship received and the number of participants. After opening speeches from the charismatic founder of Young Corporate Malaysians, Wan Mohd Firdaus and the humorous Johan Raslan the summit kicked off with speakers from Indonesia, Irhoan Tanudireja and Ferry Wong.

Speaking on the emergence of Indonesia- Irhoan Tanudireja (Left) and Ferry Wong (Right)

Indonesia: ASEAN’s Next Biggest Thing

They started off with a brief introduction to Indonesia and then a detailed, insightful analysis on the future of the Indonesian economy. Amidst the recent global financial crisis, Indonesia was one of the only three nations which still posted a positive GDP growth. It was also projected that in 2011, Indonesia will be the only country with increasing GDP growth rate while the growth of China and India slow down. With its huge population (2009 estimate: 238,000,000) supporting its domestic market, Indonesia is expected to be the next BIG thing on investors’ table.

Like Malaysia, Indonesia is blessed with abundant natural resources. It is now the largest Crude Palm Oil (CPO) producer, It also boasts its crude oil, natural gas, tin, copper, and gold. What’s more, it hasn’t fully expanded its Islamic Finance market despite being the most populous Muslim-majority nation. Indonesia certainly has the potential to be the next Islamic Finance hub. As of now, Islamic finance only contributes to about 3% of Indonesian banking assets although 86.1% of its population are Muslim. (Year 2000 Census)

According to Straits Times report on July 28, the government’s efforts to woo foreign direct investment (FDI) has been paid off. In the first 6 months of the year, FDI has soared 46%. For the April-June period alone, actual investment rose 56 per cent from the previous corresponding period to 50.8 trillion rupiah. Foreign direct investment during the three months increased 53 per cent on-year to 35.6 trillion rupiah. The number is expected to be even higher as President Susilo Bambang Yudhoyono has vowed to remove 'bottlenecks' to investment to help the country post seven per cent growth by the end of his final term in 2014, compared with 5.5 per cent this year.

However, concerns linger. Despite its stellar GDP growth figure, Indonesia has inherent weaknesses which might drag it down if they are not dealt with seriously. Its poverty rate still stands at 14% high (2010 estimate.) Its unemployment rate as high as 7.7% (2009 estimate) is perhaps the most unsettling of all. If these are not rectified, social unrest which might entail will undermine its growth. Indonesia has an interesting labor law which requires employers to pay employees who resign as long as they have served for 3 years. This incurs huge costs on the employers, forcing them to embrace contract employment. If this law is not rescinded, efforts to improve employment will be undercut.

The next main concern is its lack of high quality infrastructure crucial to sustaining its relatively high speed growth. Natural disasters such as earthquakes, landslides. tsunami and volcanic eruptions have time and time again spoilt the Indonesian attempts to improve infrastructure. The inefficient transportation system of the archipelagic nation have largely hindered Indonesians from fully realizing their potentials. Traffic congestion in the capital is extremely serious, if not notorious. “It takes me 2 hours just to get to my workplace in the financial district, Irhoan remarked, “even though my house is right inside the city.”

Corruption in Indonesia has been prevalent, if not ubiquitous. It is ranked 143rd among 180 nations in terms of Corruption Perception Index. Some businesses even claim that corruption has contributed to 20% of their operation cost, leading them to regard bribery as “indirect tax”. Overly tight and inflexible business regulation is yet another factor which holds businesses back. While new business registration in Singapore and Malaysia takes only days to process, it takes months and sometimes years in Indonesia. Other than business registration, land clearing overregulation has tied the government’s hands in executing major development. The new law which will be brought to the Parliament next month might just solve this issue. It grants pemerintah (government) the power to confiscate and buy land at market price in order to discourage speculators.

The good thing is that Indonesian government appears determinant in making the leapfrog possible. It has said that infrastructure development will be the main focus in the next 5 years. It will pump in at least U$ 140 billion of which 48.8 billion comes from Public Private Projects (PPP). It is also expected that the current government under President Susilo Bambang Yudhoyono will continue to be in power at least until the next election which will probably fall on year 2014. This has provided the political stability that Indonesia had always needed.

So, Indonesia with its vast resources, huge population is definitely going to be the next BIG thing if it successfully overcome its inherent weaknesses. We shall see how it goes in the next few years.

ASEAN: Emerging Opportunities and Challenges

From left: Chen Chow Yeoh, Peter Bird (Rothschild Investment Bank), Shireen Muhiudeen (Corston Smith Wealth Management) and John Pang (CIMB ASEAN Research Institute)

The second session started off with Shireen Muhiudeen sharing on the corporate governance in ASEAN. She summarizes and compares the corporate governance policies and their execution in the ASEAN countries. All in all, she finds that Thailand has made the most progress in terms of corporate governance. Thailand is the first among ASEAN members to adopt poll voting. To learn more about corporate governance in Thailand, there is a good resource here.

Throughout the session, she had stressed many times on the importance of corporate governance and our roles as small shareholders in overseeing it.

Peter Bird and John Pang then shared on the big picture as to where ASEAN stands both geographically and economically. With the rise of China and India, Southeast Asia seems to have come back to being what it was during the pre-colonial era: the bridge between the trade between China and India, the superpowers back then.

While Peter Bird focused on where ASEAN stands in the global environment, John Pang recounted the ancient and modern history of Southeast Asia. ASEAN was started as a intergovernmental body to prevent conflict and to contain the Communist movement back in 1960s. It was not until late then ASEAN shifts its focus to economic cooperation and even integration. ASEAN has been criticized as a meeting exclusive to the top leaders and that the people are not well informed of the progress of ASEAN. It was no surprise that nobody raised hands when John asked, “Have you heard of ASEAN Economic Community 2015 before?” He then said, “The deadline is in 5 years’ time yet no one has heard about it, that’s the problem.” For your information, ASEAN Economic Community 2015 aspires to achieve economic integration and to transform ASEAN into one single market and production base by year 2015.

In order to realize this aspiration and ultimately to remain relevant amid the competition with China and India, ASEAN has to work as one to overcome its weaknesses such as insufficient intra-ASEAN investments, stiff mutual competition and so on. Peter Bird has urged sovereign funds and businesses in ASEAN to invest more in one another like how European Union countries did. He also pointed out that ASEAN appears to be merely a geographical group, not an economic group. To put it simply, ASEAN is a group of mutually competing countries instead of that that complements each other. John Pang has also said, “We should make sure that ASEAN should be more than just a sum of the parts.” There ought to be intergovernmental rules to realize full economic integration.

In fact, a group of companies like CIMB, JobStreet.com, AirAsia and so on have have started to regard themselves as ASEAN companies. The promotional message of CIMB perhaps has said it all. To illustrate this, John Pang made an humorous note: “When the CIMB interviewer asks : ‘Do you want to work in other ASEAN countries?’ If you say ‘no’, you won’t get the job anymore. That’s how ASEAN CIMB is.”

In fact, a group of companies like CIMB, JobStreet.com, AirAsia and so on have have started to regard themselves as ASEAN companies. The promotional message of CIMB perhaps has said it all. To illustrate this, John Pang made an humorous note: “When the CIMB interviewer asks : ‘Do you want to work in other ASEAN countries?’ If you say ‘no’, you won’t get the job anymore. That’s how ASEAN CIMB is.”

While you may think that ASEAN is unrelated to you. Think about it further. Malaysia has the best alignment of interest with the proposed ASEAN Economic Community. Indonesia could have very well gone on its own as its GDP is nearly 40% out of the total ASEAN GDP. Not being able to catch up the train with Indonesia means that Malaysia will be even more irrelevant in the market.

Among the attendees, there was still doubt as to whether ASEAN can be one single entity in the future. Peter Bird replied that compared to European Union which had to integrate Eastern Europe and Western Europe, ASEAN would face less problems in integrating.

SESSION 3: The Direction of Islamic Finance in ASEAN

From the left: Qurratul Ain Zainul (Bank Negara Malaysia), Dato’ Dr Nik Norzrul Thani (Chairman, Zaid Ibrahim & Co), Hisham Abdul Rahim (Executive Director, BNP Paribas Investment Islamic) and Rafe Haneef (CEO, HSBC Amanah).

The next session was about the direction of Islamic Finance in ASEAN, the next most lucrative chunk of banking industry. While the Islamic assets now stands at U$ 1 trillion high (July 2010), it is going to reach U$ 2 trillion in the coming 3-5 years. According to Standard and Poor’s, Islamic finance market has grown at 10% p.a. for the past decade. Why it matters so much to ASEAN is that it has strong footprint in Southeast Asia, other than Middle East.

Several issues pertaining to Islamic Finance had been discussed. Among them are:

Is Islamic Finance based on sound economic principle or purely on religious and moral obligation?

Rafe Haneef, who skipped his cousin’s wedding just for Young Corporate Malaysians, answered that the role of an Islamic bank or institution is essentially a fund manager, that manages risk and rewards. There is no guarantee of reward. If you want no risk at all, put you money into the deposit account. Islamic finance operated through sharing of profit and loss between bankers and savers. In short, it is a “I can eat only when you can eat” scenario.

He then further explained how much Islamic principles coincided with The Chicago Plan 1930s. The Chicago School advocated that if someone is unwilling to undertake risk, then his funds should be kept in a deposit fund, a case which Islam has been advocating for centuries ahead.

The financial problems which have been facing us all this while can be attributed to the mismatch between deposit and loan. Bankers use deposit to invest in high risk profiles and even to speculate. Savers can retrieve their savings anytime but investments can take years to deliver. The shortage of deposit is inevitable.

The dual banking system advocated in the Chicago Plan 1930s coincided closely with Islamic finance principles. The Plan separated the loan-making function, which can belong in private banks, from the money-creation function, which belongs in government. Lending was still to be a private banking function, but lending deposited long-term savings money, not created credits.

Why does Islamic Finance base itself so heavily on the conventional system and not stress enough on the core of Sharia compliance?

Islamic finance cannot be fully realized just yet because we have been so deeply entrenched in the conventional system. The ideal Islamic Finance model gives no guarantee to depositors but conventional banking system does. Thus, in order to remain relevant on the market, Islamic finance has no choice but to follow the conventional. This situation in turn has sadly made Islamic backing indistinguishable from conventional banking.

Speaking about Shariah compliance, how do we dealt with Shariah harmonization?

The same case happens to conventional banking as well. There is discrepancy in banking regulations in many countries. It is only reasonable for Islamic banking to face such discrepancy since there are four mazhabs. What’s more, the discrepancy is mild.

SESSION 4: Where is Malaysia in ASEAN?

From the left: Dimishtra Sittampalam, Citibank, Chow Sang Hoe (Malaysia Advisory Leader, Ernst & Young), YM Tengku Dato’ Zafrul Tengku Aziz (CEO Maybank Investment), Dato Dr. Mahani Zainal Abidin (CEO, Institute of Strategic and International Studies)

The last session was perhaps the highlight of the summit. After, we are most concerned about and familiar with our very own country. I have made a table summing up the strengths, concerns and opportunities of Malaysia in ASEAN mentioned throughout the session.

Personally, I think the two most important key points of this session are the “Middle” dilemma and “Human Capital Dilemma”.

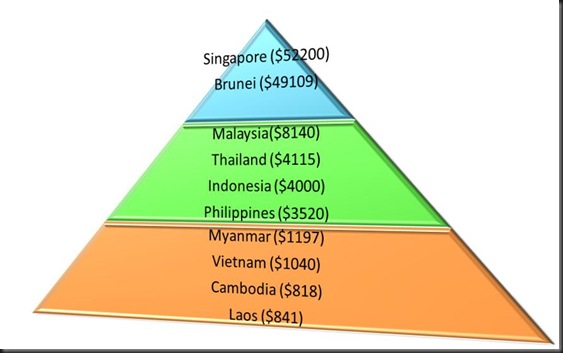

Ranking of GDP per capita (2009 estimate) in ASEAN

As how the speakers acutely pointed out, Malaysia is really stuck in the “middle”. Physically, it is in the middle of ASEAN. Economically, it belongs to middle income category. In terms of GDP growth, it is also in the middle. In terms of population, it is also of middle size: too small for domestic economy yet too big to move up value chain. The only way to move out of this “middle” trap is embracing service industry. But Malaysia is falling short of the most important ingredient: high quality human capital.

As how the speakers acutely pointed out, Malaysia is really stuck in the “middle”. Physically, it is in the middle of ASEAN. Economically, it belongs to middle income category. In terms of GDP growth, it is also in the middle. In terms of population, it is also of middle size: too small for domestic economy yet too big to move up value chain. The only way to move out of this “middle” trap is embracing service industry. But Malaysia is falling short of the most important ingredient: high quality human capital.

If we compare the composition of labor market across the world, we will find that the percentage of skilled worker out of total work force in Malaysia is less than others. While Singaporean and Korean stand at 35% and above, only 23% out of Malaysian workforce are skilled workers. The brain drain issue does not help at all. It is estimated that there are at least 1 million Malaysian experts living abroad.

Dato Dr. Mahani Zainal Abidin urges the government to not only focus on attracting foreign and Malaysian talents abroad but also on retaining and building talents in the country. Lifting up the quality of the bottom 60% of our workforce would definitely spur our economic growth.

Malaysian wage issue is yet another factor that might undermine Talent Corp’s efforts. Some might say that “if we don’t have enough talents, we can just buy them.” However, if we look at the wages across ASEAN, we would know that Malaysia simply cannot afford. The average starting salary of fresh graduates in Singapore and Indonesia is U$2100 and U$900 respectively. Malaysian fresh graduates with same skill set only cost U$ 750. This figure is definitely not attractive to foreign talents. To worsen the situation, the real wage (wage raise minus inflation) actually registered zero or even negative growth in Malaysia. Therefore, a comprehensive, systemic review on Malaysia human capital market is highly needed. The annual wage review mechanism of Singapore could be an example.

Chow Sang Hoe from Ernst and Young then concluded the session by directing the focus back to “YOU”. He urged us to accept and leverage on the “given”s (such as geographic locations, cultural diversity) and to act on “what we can change” (such as mindset). He remarked that the youths he met can be divided into 2 categories, one who keep complaining and relying on government and one who do real things. He has also personally witnessed how hard and sincere everyone in PEMANDU including its 50 project managers works. So, instead of dragging down when government plan is not working, we should give feedback and contribute what we can. Is it not the basic responsibility of being a “rakyat”?

That’s all that I can recall. Please correct me if I have made any mistake. Hope that this post can help those who did not get to attend. By the way, the goodie bag from the summit was AWESOME.

Photos in this blog post are used on the courtesy of Gabrielle Chong Yong Wei and graphical illustrations are my own works =)

9GEYZ7CN3TCGSome reference book you might want to read.

Comments are welcomed and encouraged on ZewSays.com, but there are some instances where comments will be edited or deleted as follows:

1) Comments deemed to be spam or questionable spam will be deleted. Including a link to relevant content is permitted, but comments should be relevant to the post topic.

2) Comments including profanity will be deleted.

3) Comments containing language or concepts that could be deemed offensive will be deleted.

4) Comments that attack a person individually will be deleted.

The owner of this blog reserves the right to edit or delete any comments submitted to this blog without notice. This comment policy is subject to change at anytime.

Facebook Blogger Plugin: Created by ZewSays.com

0 comments:

Post a Comment